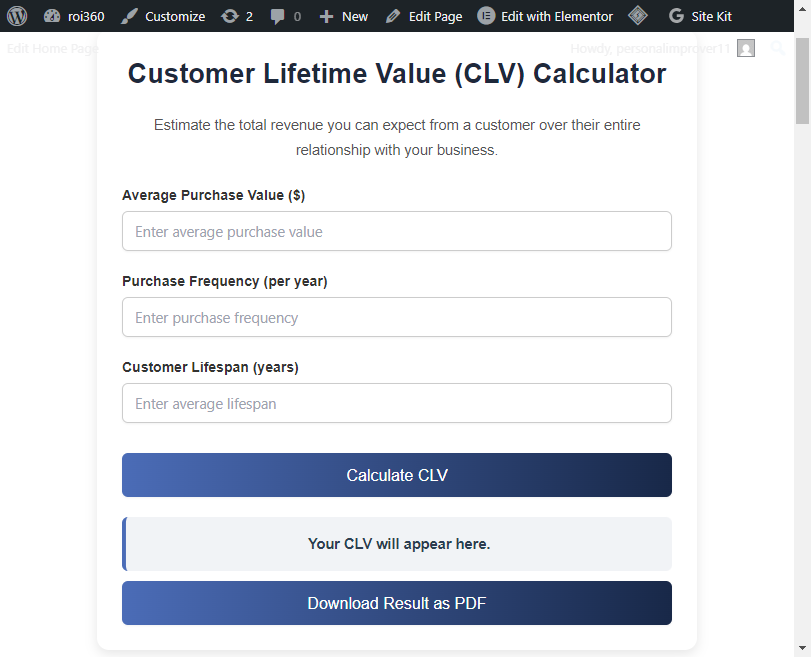

Customer Lifetime Value (CLV) Calculator

Estimate the total revenue you can expect from a customer over their entire relationship with your business.

Explore More Free Digital Marketing Calculators

Looking for more tools to improve your marketing performance? Try our complete collection of free digital marketing calculators below. From ROI and CTR to CLV, CAC, and NPS, each calculator helps you measure, analyze, and optimize your campaigns with ease.

- ROI Calculator

- CTR Calculator

- CPC Calculator

- CPM Calculator

- Conversion Rate Calculator

- Bounce Rate Calculator

- CLV Calculator

- CAC Calculator

- ROAS Calculator

- Gross Margin Calculator

- Engagement Rate Calculator

- Email Open Rate Calculator

- Email Click Rate Calculator

- CPL Calculator

- Video CPM Calculator

- Share of Voice Calculator

- Churn Rate Calculator

- Retention Rate Calculator

- AOV Calculator

- NPS Calculator

CLV Calculator – Measure Customer Lifetime Value in Digital Marketing:

In modern business and digital marketing, not all customers are equal. Some customers bring much more long-term value than others. That’s where Customer Lifetime Value (CLV) becomes a crucial metric. Our free CLV Calculator is a simple yet powerful digital marketing calculator that helps you determine how much profit a customer contributes to your business throughout their relationship with you.

What is CLV (Customer Lifetime Value)?

Customer Lifetime Value (CLV) is the predicted total revenue a customer generates for your business during their entire relationship with your brand.

CLV = Average Order Value × Purchase Frequency × Customer Lifespan

For example:

Average Order Value = $50

Purchase Frequency = 4 times per year

Customer Lifespan = 5 years

CLV = $50 × 4 × 5 = $1,000

This means each customer is worth $1,000 to your business over time.

Why CLV Matters?

CLV helps businesses understand the long-term profitability of their customers. It is essential for:

Measuring ROI of marketing campaigns

Improving customer acquisition strategies

Budget allocation for retention vs. acquisition

Identifying high-value customers

Increasing overall profitability

A business that focuses on CLV rather than just short-term sales is more likely to succeed in the long run.

How to Use Our CLV Calculator?

Our CLV Calculator is designed for marketers, entrepreneurs, and business owners. To calculate:

Enter your Average Order Value (AOV).

Enter the Purchase Frequency (times a customer buys per year).

Enter the Customer Lifespan (in years).

Click Calculate.

Instantly get the Customer Lifetime Value (CLV).

This simple digital marketing calculator can be used for eCommerce stores, subscription businesses, SaaS, and service-based companies.

Example CLV Calculations:

Example 1: eCommerce Store

AOV: $40

Frequency: 3 times per year

Lifespan: 4 years

CLV = $40 × 3 × 4 = $480

Example 2: SaaS Company

AOV (monthly subscription): $30

Frequency: 12 times per year

Lifespan: 3 years

CLV = $30 × 12 × 3 = $1,080

Example 3: Gym Membership

AOV: $50/month

Frequency: 12 months

Lifespan: 2 years

CLV = $50 × 12 × 2 = $1,200

CLV vs. CAC:

One of the most important comparisons in marketing is CLV vs. CAC (Customer Acquisition Cost).

CLV (Customer Lifetime Value): Measures how much a customer is worth over time.

CAC (Customer Acquisition Cost): Measures how much it costs to acquire a new customer.

CLV should be at least 3× higher than CAC for sustainable profitability.

Factors That Influence CLV:

Customer Experience – Happy customers stay longer.

Product/Service Quality – High quality increases repeat purchases.

Customer Support – Good support increases loyalty.

Marketing Efforts – Retargeting, loyalty programs, and email marketing boost CLV.

Cross-Selling & Upselling – Encourage customers to spend more.

Best Practices to Increase CLV:

Build Customer Loyalty Programs – Reward repeat customers.

Personalize Offers – Tailored recommendations drive purchases.

Improve Retention Strategies – Reduce churn with better engagement.

Focus on Customer Service – Exceptional service builds long-term trust.

Introduce Subscription Models – Subscriptions extend lifespan and revenue.

Common Mistakes Businesses Make:

Only focusing on acquisition, ignoring retention.

Not calculating CLV at all.

Offering discounts without strategy.

Ignoring customer churn rate.

Not segmenting customers by value.

Our CLV Calculator ensures you always know the long-term worth of your customer.

Conclusion:

The CLV Calculator is a vital digital marketing calculator that helps you understand customer value over the long term. By calculating CLV, you can:

Allocate marketing budgets effectively

Improve acquisition strategies

Focus on retention and loyalty

Increase profitability

What is a good CLV?

Depends on industry. SaaS and subscriptions often aim for $1,000+ CLV

How often should i calculate CLV?

Quarterly or annually, depending on your business model

Does CLV affect marketing budget?

Yes, higher CLV allows more spending on acquisition

Can CLV help reduce churn?

Yes, by identifying high-value customers, you can focus retention strategies

Is CLV only for big buisinesses?

No, even small businesses can benefit from tracking CLV