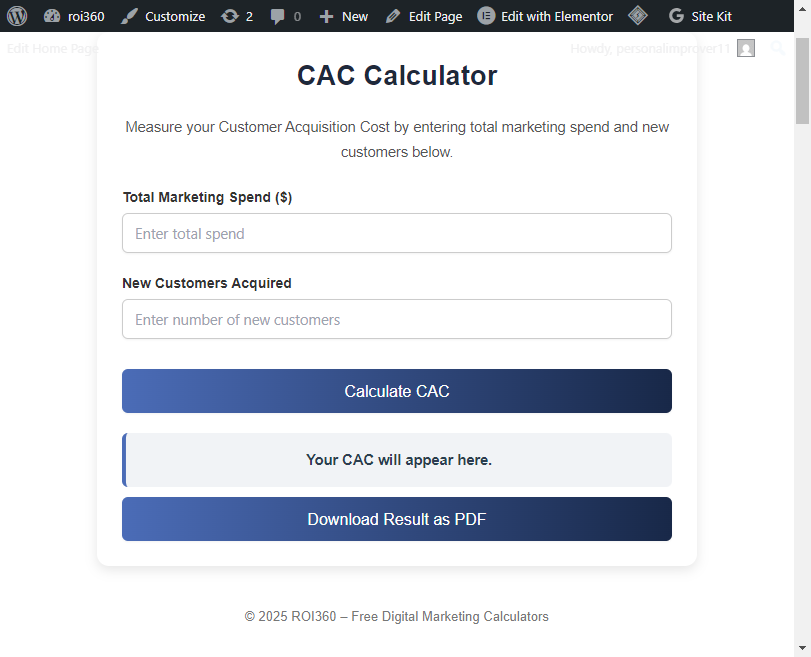

CAC Calculator

Measure your Customer Acquisition Cost by entering total marketing spend and new customers below.

Explore More Free Digital Marketing Calculators

Looking for more tools to improve your marketing performance? Try our complete collection of free digital marketing calculators below. From ROI and CTR to CLV, CAC, and NPS, each calculator helps you measure, analyze, and optimize your campaigns with ease.

- ROI Calculator

- CTR Calculator

- CPC Calculator

- CPM Calculator

- Conversion Rate Calculator

- Bounce Rate Calculator

- CLV Calculator

- CAC Calculator

- ROAS Calculator

- Gross Margin Calculator

- Engagement Rate Calculator

- Email Open Rate Calculator

- Email Click Rate Calculator

- CPL Calculator

- Video CPM Calculator

- Share of Voice Calculator

- Churn Rate Calculator

- Retention Rate Calculator

- AOV Calculator

- NPS Calculator

CAC Calculator – Measure Customer Acquisition Cost in Digital Marketing:

In every business, understanding how much it costs to acquire a new customer is critical. The Customer Acquisition Cost (CAC) is a key metric that helps you evaluate the efficiency of your marketing and sales efforts. With our free CAC Calculator, you can instantly calculate your acquisition cost and improve your decision-making.

What is CAC (Customer Acquisition Cost)?

Customer Acquisition Cost (CAC) is the total cost of acquiring a new customer, including marketing, advertising, and sales expenses.

CAC = Total Marketing & Sales Spend ÷ Number of New Customers Acquired

For example:

If you spent $5,000 on marketing and sales in a month and acquired 100 new customers,

CAC = $5,000 ÷ 100 = $50 per customer

This means each customer costs you $50 to acquire.

Why CAC Matters?

CAC is a critical metric because it shows whether your business is growing profitably or not.

Helps measure marketing efficiency

Influences ROI and profitability

Guides pricing and budgeting decisions

Provides insight into scalability

Helps balance acquisition vs. retention

If CAC is too high, you’re spending too much to gain customers. If it’s low, you have efficient acquisition strategies.

How to Use Our CAC Calculator?

Our CAC Calculator is easy to use for startups, eCommerce stores, SaaS companies, and agencies:

Enter your total marketing & sales spend.

Enter the number of new customers acquired.

Press Calculate.

Get your Customer Acquisition Cost instantly.

This digital marketing calculator works for monthly, quarterly, or annual CAC tracking.

Example CAC Calculations:

Example 1: Startup Marketing Campaign

Spend: $10,000

New Customers: 500

CAC = $10,000 ÷ 500 = $20 per customer

Example 2: SaaS Business

Spend: $50,000

New Customers: 2,000

CAC = $50,000 ÷ 2,000 = $25 per customer

Example 3: E-commerce Store

Spend: $30,000

New Customers: 1,000

CAC = $30,000 ÷ 1,000 = $30 per customer

CAC vs. CLV:

CAC alone doesn’t tell the whole story. The true measure of profitability comes when comparing CAC vs. CLV (Customer Lifetime Value).

If CLV > 3 × CAC → Business is profitable.

If CLV < CAC → Business is unsustainable.

Average CAC Benchmarks by Industry:

+SaaS: $100 – $1,000+

E-commerce: $20 – $50

B2B Services: $200 – $1,000

Education: $100 – $500

Healthcare: $200 – $800

Factors That Influence CAC:

Marketing Channel – Paid ads vs. organic SEO

Sales Cycle Length – Long cycles increase CAC

Target Audience – Narrow targeting may cost more

Competition Level – High competition increases CAC

Conversion Rate – Low conversions push CAC higher.

Best Practices to Reduce CAC:

Invest in SEO & Content Marketing – Free, long-term traffic.

Leverage Referrals & Word of Mouth – Low-cost customer acquisition.

Improve Conversion Rate – Better landing pages reduce CAC.

Focus on Retargeting – Bring back warm leads at lower cost.

Automate Marketing – Email and chatbots save resources.

Common Mistakes in Calculating CAC:

Ignoring hidden costs like salaries and tools.

Only focusing on short-term results.

Not segmenting CAC by channel.

Comparing CAC without CLV.

Our CAC Calculator ensures you calculate this metric accurately.

Conclusion:

The CAC Calculator is an essential digital marketing calculator that helps you measure how much it costs to acquire each customer. By calculating CAC, you can:

Control marketing and sales spend

Improve efficiency

Compare against CLV

Make smarter business decisions

What is a good CAC?

It depends on industry, but generally CAC should be less than one-third of CLV

Does CAC include salaries?

Yes, if those employees are directly involved in sales/marketing

How often should i calculate CAC?

Monthly for fast-changing industries, quarterly for others

Is a lower CAC always better?

Not always. Sometimes higher CAC is okay if CLV is much higher

Can CAC help attract investors?

Yes, CAC is one of the key metrics investors look at